19+ Oklahoma Payroll Calculator

For example if an. Web Oklahoma Payroll Calculators.

Formplus

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

. Web If your gross pay is 0 per -in the state of F your net pay or take home pay will be 134317 after tax deductions of 0 or 15683Deductions include a total of 1 0 or. Choose your pay frequency eg weekly bi-weekly monthly. Calculate your Oklahoma net pay or take home pay by entering your pay information W4 and Oklahoma state W4 information.

Web Using a Payroll Tax Service. Web Free Paycheck Calculator to calculate net amount and payroll taxes from a gross paycheck amount. Web Use ADPs Oklahoma Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

The living wage for a single adult in Oklahoma is 1094 and for a couple one working with. Web Federal Paycheck Calculator Photo credit. This precise calculator ensures.

Web To effectively use the Oklahoma Paycheck Calculator follow these steps. Web Oklahoma - OK Paycheck Calculator. Paycheck Calculator is a great payroll calculation tool that can be.

Web These paycheck details are based on your pay info and our latest local and federal tax withholding guidance. Web The Year of the Dragon starts on February 10 2024 following the Year of the Rabbit. Web Hourly Rates Amount Earnings Gross Pay 000 Gross Pay Method Gross Pay YTD Pay Frequency Federal Taxes enter your W4 info Use 2020 W4 Federal Filing Status Step.

Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Oklahoma. Web Oklahoma Paycheck Calculator Calculate your take-home pay after federal Oklahoma taxes Updated for 2023 tax year on Dec 05 2023 What was updated. Just enter the wages tax withholdings and other.

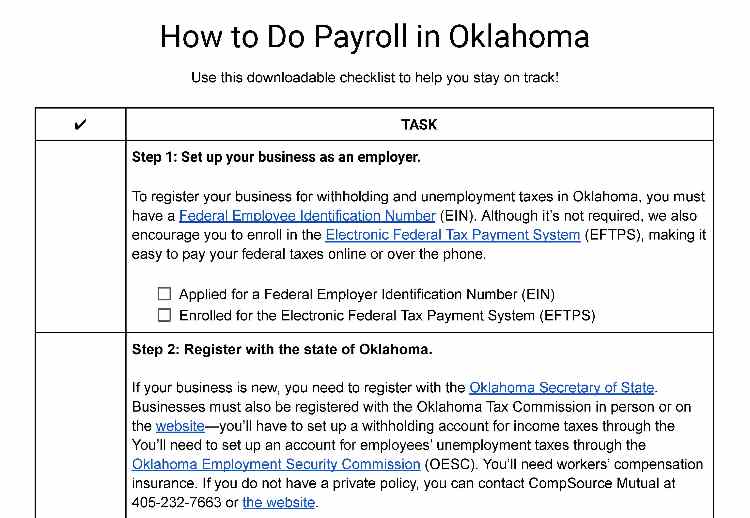

Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Web How to calculate annual income. In Oklahoma payroll and payroll taxes come with countless laws and restrictions which is why many business owners turn to a.

877 729-2661 to speak with Netchex sales and discover how robust our reporting is providing invaluable insights to your business. Web Oklahoma Salary Paycheck Calculator Calculate your Oklahoma net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. The House voted Wednesday to expand the child tax credit and to bolster some corporate tax breaks.

Web Fill out our contact form or call. Simply enter their federal and state. Oklahoma payroll taxes start with employees filling out Form OK-W-4.

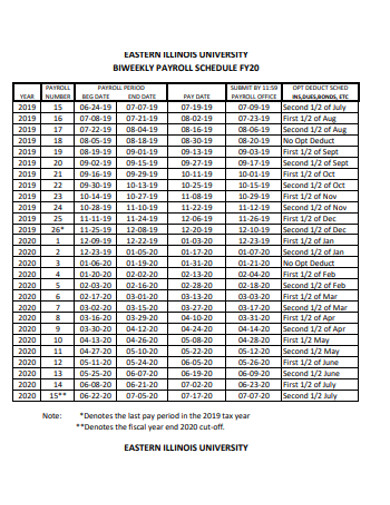

Web Oklahoma Paycheck Calculator Advertiser Disclosure Oklahoma Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other. Heres what you need to know about withholding payroll taxes in Oklahoma. Web Oklahoma Payroll Calculator 2024 Calculate payroll costs for up to 20 employees in Oklahoma in 2024 for free view alternate tax years available.

Web January 31 2024 at 839 pm. Web Oklahoma payroll taxes. This free hourly and salary paycheck calculator can estimate an.

Web The Oklahoma Payroll Calculator is a vital tool for business owners HR professionals and accountants in Oklahoma. You can find detailed. Enter your gross pay for the pay period.

45 1006 reviews. Many of us have already forgotten about our New Years.

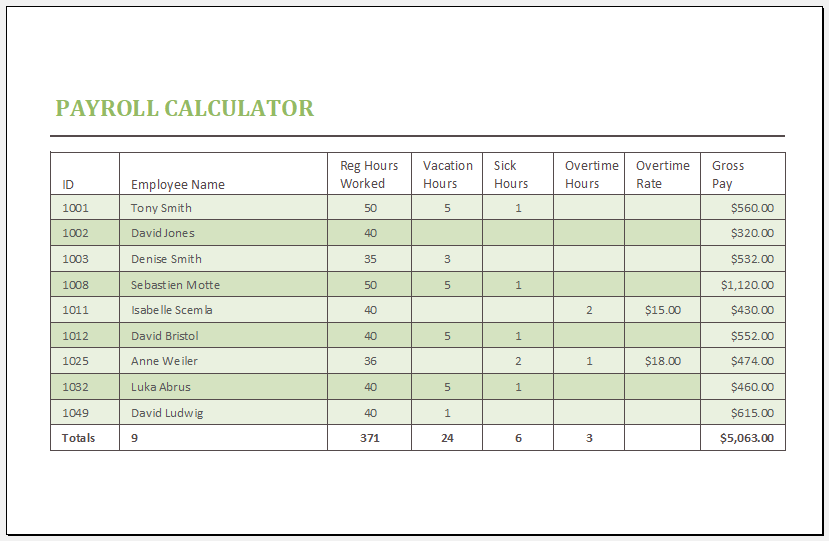

Excel Templates

Etsy

Examples

Money Geek

Dashvapes

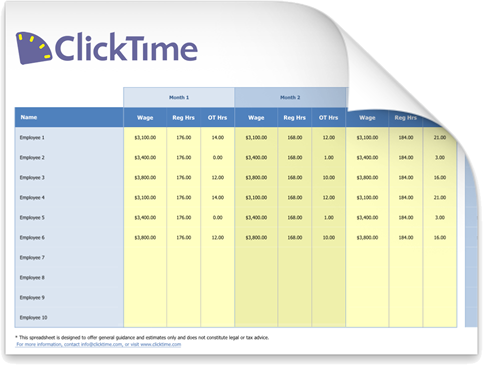

Clicktime

Mckissock

Spreadsheet123

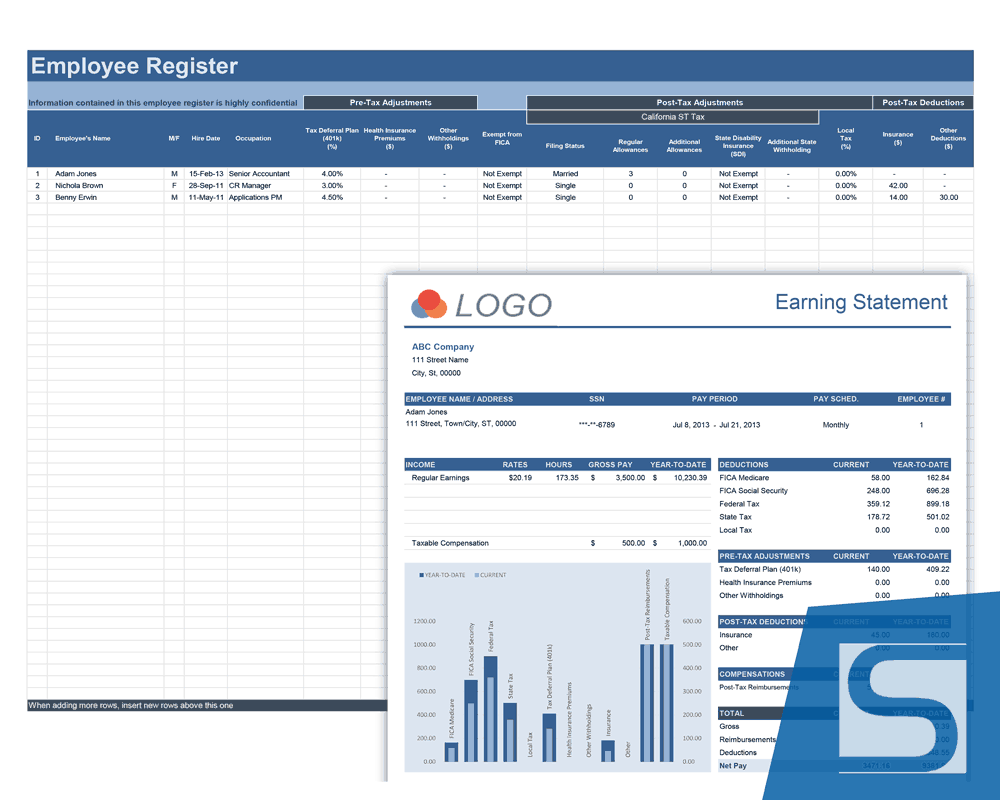

Template Net

Spreadsheet123

Covers Com

Fit Small Business

Mckissock

Covers Com

2

Dashvapes

Clockify